Tips & Tricks

7 min read

Emerging Technologies in the Financial Services Industry

Walk into any bank branch today and you will notice something subtle but important. The counters are quieter. Fewer forms are printed. Many decisions that once took days now happen in seconds. This shift is not cosmetic. It is the result of a deep technological transformation that is reshaping how financial institutions operate, compete, and manage risk.

Unlike past waves of digitization, the current transformation is not driven by a single breakthrough. It is happening because multiple technologies are maturing at the same time, forcing banks, fintech firms, insurers, and asset managers to rethink everything from compliance to customer relationships.

What follows is not a list of buzzwords. It is a closer look at how emerging technologies are actually being used inside financial services today, where they are delivering value, and where the friction remains.

For decades, technology in finance focused on efficiency. Systems automated bookkeeping, reconciliations, and reporting. Today, the focus has shifted toward decision making itself.

Artificial intelligence now sits at the center of this change. Modern financial institutions use AI to evaluate creditworthiness, detect fraud in real time, and personalize products at scale. These systems do not simply flag anomalies. They learn from behavior, adapt to new patterns, and improve continuously.

Large institutions such as JPMorgan Chase use AI models to support human analysts in risk management and compliance. Rather than replacing expertise, AI acts as a second layer of judgment, scanning volumes of data no human team could realistically process.

This shift matters because it changes how financial risk is understood. Instead of relying on static models updated quarterly, institutions can respond dynamically as conditions change.

Blockchain technology has spent years trapped between promise and skepticism. That balance is finally changing.

In financial services, blockchain is no longer treated as a speculative experiment tied only to cryptocurrencies. It is increasingly used as infrastructure. Banks are deploying distributed ledgers for cross border payments, trade finance, and identity verification.

Central banks have also entered the picture. The Reserve Bank of India, for example, has piloted blockchain based systems for its digital currency initiatives, focusing on transparency and settlement efficiency rather than decentralization ideology.

What makes blockchain attractive to financial institutions is not anonymity or speculation. It is auditability and trust. Immutable transaction records reduce reconciliation costs, simplify compliance, and lower counterparty risk. That practical value is why adoption continues even as public enthusiasm fluctuates.

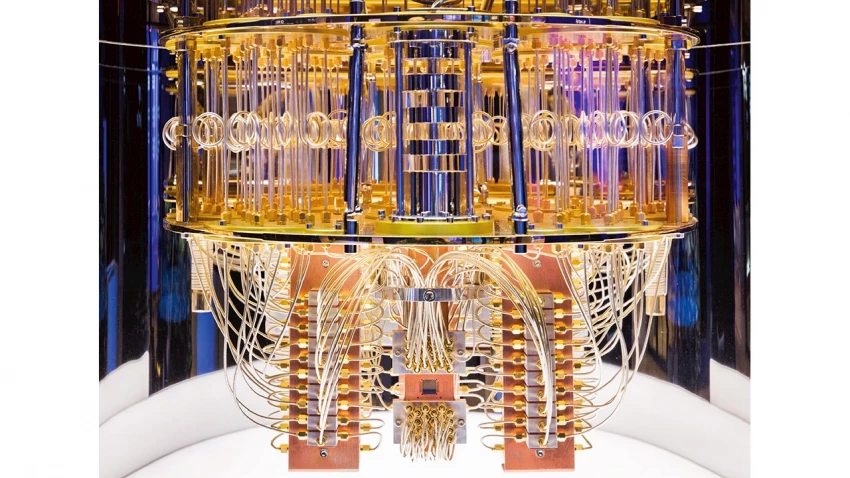

Quantum computing remains early, but it is no longer theoretical in finance.

Several global institutions have begun pilot programs to test quantum algorithms for portfolio optimization and risk modeling. HSBC, working with technology partners, has demonstrated quantum approaches to bond trading that solve complex optimization problems faster than classical systems.

The immediate benefit is not speed alone. It is problem complexity. Quantum systems can explore scenarios that classical models struggle with, particularly in stress testing and long horizon risk forecasts.

That said, quantum computing also introduces new concerns. Encryption standards that protect financial data today may not be secure in a quantum future. As a result, institutions are investing in quantum resistant cryptography even before quantum systems are widely deployed.

If there is one technology that underpins nearly every other innovation in finance, it is cloud computing.

Financial institutions have moved beyond using the cloud only for peripheral workloads. Core banking systems, payment processing, and analytics platforms are increasingly cloud native. This shift enables scalability, faster deployment, and real time data access.

Cloud adoption also supports new business models. Banking as a Service allows fintech companies to offer financial products without holding a banking license. Embedded finance lets retailers, travel platforms, and even mobility services integrate payments and lending directly into their customer journeys.

The trade off is complexity. Cloud environments demand stronger governance, continuous monitoring, and new security practices. Institutions that underestimate this quickly discover that flexibility without discipline creates risk.

As financial innovation accelerates, regulation has not slowed down. In many regions, it has intensified.

This pressure has given rise to RegTech, a category focused on automating compliance, reporting, and risk monitoring. RegTech platforms use APIs, AI, and data analytics to handle tasks that once required large compliance teams.

Know Your Customer checks, anti money laundering monitoring, and transaction reporting can now be executed in near real time. Open banking frameworks in Europe and parts of Asia further expand the role of RegTech by standardizing how financial data is shared securely.

The strategic benefit is not just cost reduction. Automated compliance allows institutions to scale safely, launching new products without multiplying regulatory overhead.

As financial systems become more digital, cyber risk has shifted from perimeter defense to behavior analysis.

Traditional security tools focused on known threats. Modern systems monitor how users, devices, and applications behave over time. AI driven cybersecurity platforms can detect subtle deviations that indicate fraud or account takeover attempts.

Biometric authentication, adaptive access controls, and continuous verification are now standard across many digital banking platforms. The goal is to make security invisible but effective, protecting users without interrupting legitimate activity.

At the same time, attackers are also using AI. This creates an ongoing escalation where financial institutions must treat cybersecurity as a living system rather than a static control.

Perhaps the most visible impact of emerging technologies is how customers interact with financial services.

Conversational AI has replaced long wait times with instant responses. Chatbots now handle account queries, payments, and even basic financial guidance. Over time, these systems are becoming less transactional and more contextual.

Personalization is the underlying driver. Financial institutions can tailor advice, alerts, and offers based on individual behavior rather than broad segments. This creates experiences that feel more relevant, but it also raises questions about data use and transparency.

Trust remains the currency that matters most. Institutions that fail to explain how data is used risk eroding confidence, no matter how advanced their technology appears.

Environmental and social concerns are no longer peripheral to finance. Technology is playing a central role in making sustainability measurable.

AI models can estimate the carbon impact of portfolios. Blockchain systems can track the use of funds raised through green bonds. These tools move sustainability beyond marketing into verifiable action.

Regulators and investors increasingly demand this level of accountability. Financial institutions that cannot demonstrate impact may find themselves excluded from capital flows.

By 2026, the most competitive financial institutions will not be defined by who adopts the most technology, but by who integrates it most coherently.

Agent based AI systems will handle routine workflows end to end. Embedded finance will blur the boundaries between financial and non financial services. Quantum tools will influence strategic planning long before they reach production scale.

The institutions that succeed will be those that simplify where possible, automate where necessary, and maintain human oversight where judgment matters most.

Emerging technologies in financial services are not about disruption for its own sake. They are about rebuilding trust, speed, and resilience in a system that touches nearly every part of modern life.

The industry is moving away from rigid processes toward adaptive systems. That transition brings opportunity, but also responsibility. Technology can amplify both good decisions and bad ones.

Financial institutions that understand this balance will not just keep pace with change. They will help define what the next era of finance looks like.

Be the first to post comment!