Software

3 min read

Everything You Need to Know About RazorpayX Payroll, Banking, and App Performance

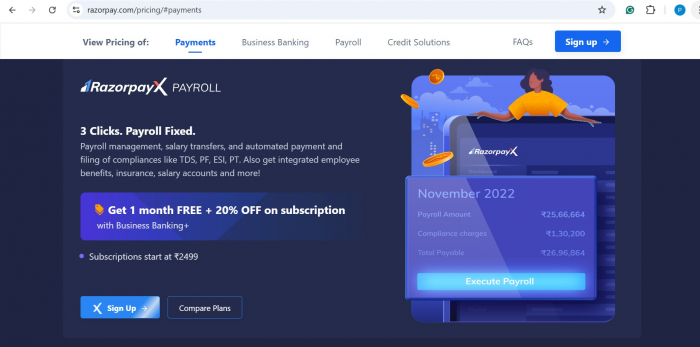

RazorpayX Payroll is an all-in-one automating solution for handling salaries, reimbursements, attendance, employee onboarding, and tax compliance all with minimal manual effort, tight integration, and fast execution.

But how well do these solutions perform in real-world conditions? This article looks at Razorpay’s broader ecosystem, RazorpayX Business Banking, and RazorpayX Payroll. It’s built entirely on factual insights derived from product screenshots, pricing pages, user feedback, and app store reviews. It will help you understand what works, what doesn’t, and whether it fits your business needs.

Razorpay supports online payments (gateway, Magic Checkout, subscriptions, Smart Collect) and offline options like POS and WhatsApp Pay. New features include embedded payments, Optimizer, and app integrations. These tools are aimed at making customer payments smoother across platforms and channels.

Key Offerings:

RazorpayX Payroll offers automation for salaries, tax filings, attendance tracking, and employee benefits—all within a single dashboard.

Core Features:

It caters to both startups and larger enterprises, with separate workflows for each.

_1745820479.png)

Access control is integrated with team-based permissions, and actions like payment approvals can be done directly from the RazorpayX mobile app.

RazorpayX Payroll follows a flat, per-user pricing structure:

There are no hidden costs or commission-based pricing layers listed on the official site.

According to the Play Store listing and user reviews, the RazorpayX mobile app offers:

Notable Features:

Reported Issues:

Razorpay’s services currently cater to:

Razorpay feels like its strength lies in how seamlessly it brings payments, payroll, banking, and compliance under one roof. What stands out most is its attention to the Indian market’s actual needs, automated GST, UPI, TDS filings, and local payment methods, all without the usual tech chaos.

While the product features are extensive, execution and user experience can vary dramatically, especially for time-sensitive functions like payroll or tax filing.

Businesses considering RazorpayX should conduct a phased rollout. Testing with the free plan, exploring integrations, and having backup banking channels may help mitigate operational risk while assessing its full suitability.

Be the first to post comment!