Trading in the Indian stock market is fast, unpredictable, and often overwhelming. That’s why artificial intelligence has become a powerful ally for retail and professional traders alike. Among the new players, GOC Genie, developed by GOC Technology, has caught attention as a platform designed specifically for the NSE (National Stock Exchange of India).

But how does it compare to other AI-powered trading platforms? What exactly is “Beast Mode”, the most talked-about feature? And is it worth the investment? I decided to dig deep into what GOC Genie offers, how it works, and what real traders are saying.

GOC Genie is an AI-driven stock analysis and trading support tool built for the Indian market. Unlike global trading AI platforms that focus on U.S. or international exchanges, this tool is localized for Indian equities, futures & options, and indices.

The platform is part of GOC Technology, founded in 2019 by Girish Khemnani, better known for his YouTube channel Game of Charts, which has over 181,000 subscribers. His focus has always been to simplify trading education, and GOC Genie extends that philosophy by turning real-time data into visual, easy-to-understand signals.

So, what makes GOC Genie different from standard trading software? Let’s break down its major features:

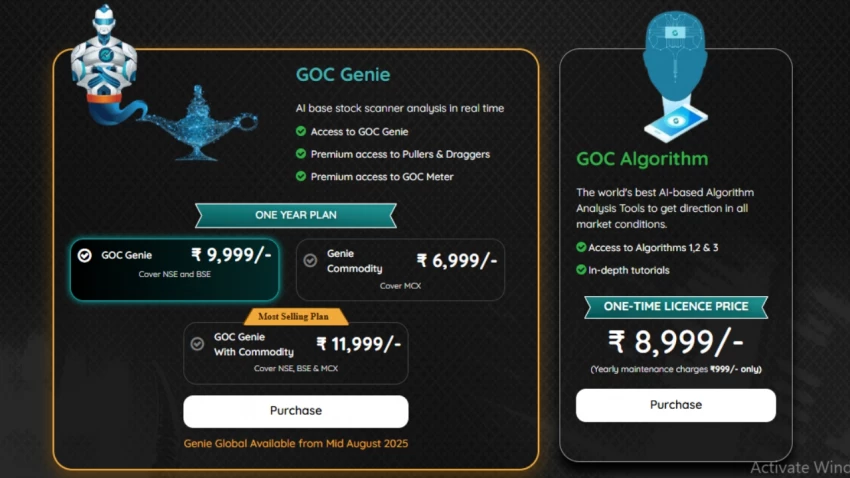

A one-year subscription to GOC Genie costs ₹9,999, which includes:

Compared to global AI trading tools like Trade Ideas (over $2,000 annually) or TrendSpider (around $500 annually), GOC Genie’s price is very competitive, especially given its NSE-specific focus.

The name sounds dramatic, but Beast Mode is essentially the unlocked version of GOC Genie, providing full access to premium features.

Based on official details and trial access, Beast Mode includes:

While GOC Technology doesn’t reveal every feature of Beast Mode, it’s safe to say it’s the all-in-one package, designed for serious traders who want maximum insights without limits.

Some traders speculate it may also include faster updates, priority alerts, or broader coverage (such as commodities), but that hasn’t been confirmed yet.

When placed side by side with other AI trading platforms, here’s where GOC Genie stands out:

| Platform | Strengths | Weaknesses |

|---|---|---|

| GOC Genie | NSE-focused, real-time scanning, simplified visuals, affordable price | Limited to Indian markets, smaller community than global tools |

| Trade Ideas | Advanced AI bots, strategy automation, large U.S. user base | Expensive, U.S.-centric, steep learning curve |

| TrendSpider | Automated technical analysis, chart pattern recognition | Higher price, not tailored for NSE |

| SignalStack | Automated execution of signals | Works best with U.S. platforms, more complex setup |

Verdict:

If your trading is India-focused, GOC Genie is a better fit. If you want broader, global markets and automation, global tools might serve you better.

So, what do actual traders say?

On Reddit (r/StockMarketIndia), one user shared:

“I am using GOC Genie… It provides stocks for scalping, intraday and short-term investment.”

Another comment added:

“It’s good for cash intraday trades.”

On Medium, one review described GOC Genie as the “GPS of Indian stock markets”, praising its real-time updates but warning not to rely on it blindly—reminding traders that no AI tool is foolproof.

Overall sentiment: Traders find it practical for intraday strategies, especially scalping and quick decision-making.

If you trade in the Indian stock market, especially intraday or F&O, GOC Genie is a strong value proposition. It’s affordable, tailored for NSE, and provides actionable signals without overwhelming complexity.

“Beast Mode” unlocks the full power of the platform, making it a solid choice for active traders who want everything in one place.

That said, it’s not a replacement for personal research, discipline, and risk management. Like any AI tool, it should be used as a compass, not a guarantee.

At ₹9,999 per year, it’s an investment most active traders could justify, especially compared to much more expensive global platforms.

Be the first to post comment!