Software review platforms are websites where customers leave ratings, written reviews, pros/cons, and comparisons for B2B or consumer software. Common examples include G2, Capterra, GetApp, Software Advice, and Trustpilot.

They usually offer:

● Category pages (e.g., “Best CRM software”)

● Vendor profiles

● Verified reviews / moderation processes (varies)

● Comparison pages and grids

● Lead capture (e.g., “Get pricing”, “Request demo” buttons)

Modern B2B buyers do heavy research independently before talking to sales. Gartner reports many buyers prefer a rep-free experience and do their research through digital channels.

In that research phase, review platforms help buyers:

● Shortlist options quickly

● Compare alternatives in one place

● Validate claims with real user outcomes and tradeoffs

● Get confidence to book a demo or start a trial

Evidence that buyers actively use review platforms:

● G2 reports that 31% consult review sites more often than other sources (from its 2024 Buyer Behavior research page).

● Capterra’s UK report says 54% of “successful adopters” use reviews to inform buying research.

● Social proof: people copy others’ choices when uncertain.

● Authority/third-party validation: people give more weight to “independent” sources than brand claims (authority bias is a documented cognitive bias).

In software buying, uncertainty is high (integration cost, switching risk, stakeholder pressure), so these effects intensify.

Reviews answer the exact objections that stop conversions:

● Implementation reality

● Support responsiveness

● ROI timelines

● Hidden limitations

This matters because software purchases have real regret risk (Capterra highlights widespread buyer regret/disruption in software adoption surveys).

Your website is expected to be positive. Review sites feel like:

● “People like me used this and survived.”

● “Here are the tradeoffs (not just the upsides).”

That balanced credibility is persuasive.

Extremely high ratings with no nuance can look fake. The Spiegel Research Center notes that “5 stars” can sometimes be less persuasive than slightly lower ratings because it may feel “too good to be true.”

● Spiegel Research Center: when reviews were displayed, conversion increased 190% (lower-priced) and 380% (higher-priced) in their research examples.

● Spiegel also reports “purchase likelihood for a product with five reviews is 270% greater than a product with no reviews.” (LinkedIn)

● Bazaarvoice reports that for Petco, visitors who engage with reviews had 8% higher conversion rate (and 15% higher revenue per visitor).

● PowerReviews survey: 98% of consumers say reviews are an essential resource for purchase decisions.

● Problem: find higher-quality in-market leads and improve conversion efficiency

● How: used G2 Buyer Intent signals layered with their own targeting

● Results: 17% higher conversion rate, 27% lower cost per lead, 4x ROI on campaign spend; added 400 more MQLs attributed to G2 intent.

● Problem: improve paid campaign performance and efficiency

● How: ran G2 “Product Ads” (and leveraged G2 presence)

● Results: 2x ad lead conversion rate, 20% lower cost per lead.

● Problem: identify high-intent prospects; improve outreach timing

● How: used G2 Buyer Intent + review generation + content subscription

● Results: sales outreach influenced by G2 intent helped them close deals ~20% faster (sales-cycle speed improvement).

● Problem: increase trust and performance across funnel

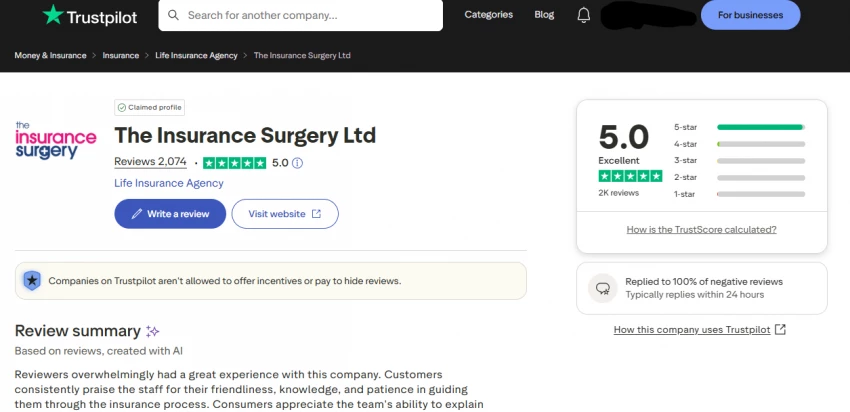

● How: prominently leveraged Trustpilot reviews and integrations

● Results: 39% increase in website sessions and 27% increase in conversions within the first year.

● Problem: turn trust into measurable on-site results

● How: embedded Trustpilot TrustBoxes (reviews on site)

● Results: reported 30% increase in conversions tied to adding reviews on the website via widgets.

| Platform | Best known for | Typical buyer intent stage | Key strength | Limitation / risk |

| G2 | B2B software discovery + comparisons | Mid → Bottom funnel | Strong category discovery and peer comparisons; large review volume (G2 says 3M+ reviews and reach to 100M+ buyers). | Competitive categories can be crowded; vendor programs are often paid/quote-based |

| Capterra (Gartner Digital Markets) | Software marketplace, SMB-heavy | Mid funnel | High-intent category traffic; verified review emphasis (Capterra reports 2M verified reviews milestone). | Lead costs vary by category; brand differentiation can be hard without strong review volume |

| GetApp (Gartner Digital Markets) | Software comparisons | Mid funnel | Comparison-first browsing; part of Gartner Digital Markets network. | Similar “directory” crowding effect

|

| Software Advice (Gartner Digital Markets) | Advisor-assisted software selection | Mid → Bottom | Includes human advisor support; claims 2.5M+ verified reviews and 1M+ businesses helped. | Lead qualification depends on category and buyer readiness |

| Trustpilot | Broad consumer + SMB trust layer | Top → Bottom (brand trust) | Huge scale (300M+ reviews, Trust Report). | Reputation/fraud debates exist in public discourse; requires active review management and transparency. |

Review platforms rank for queries like:

● “Best [category] software”

● “[Your product] reviews”

● “[Competitor] alternatives”

Those searches are often MOFU/BOFU and convert better than broad informational searches.

When buyers see your brand on:

● Your site

● A review platform profile

● Comparisons/grids

…they’re more likely to click and convert because it looks real (not “a website that claims it’s great”).

Gartner highlights buyers doing independent research digitally and avoiding irrelevant outreach.

Review platforms fit this behavior perfectly: buyers can evaluate without a sales call.

● B2B SaaS: start with G2 + Gartner Digital Markets (Capterra/GetApp/Software Advice)

● Consumer-heavy or SMB trust layer: add Trustpilot

● Clear positioning + use cases

● Accurate feature lists

● Integrations and customer segments

● Real screenshots and pricing transparency (as much as you can)

● Trigger review requests at “value moments”:

○ after onboarding success

○ after a support win

○ after renewal

● Never buy or fabricate reviews.

● Add review widgets or proof blocks on:

○ Pricing page

○ Trial/signup page

○ Demo request page

○ Competitor comparison pages

(Trustpilot case studies show measurable lift after adding widgets.)

● Train sales to send the right review link:

○ “Here’s what finance teams say”

○ “Here’s what companies your size say”

● For intent platforms (like G2 Buyer Intent), use it to time outreach (ZoomInfo/Tesorio examples).

● Respond to negative reviews with:

○ acknowledgement

○ fix/action taken

○ timeline

○ follow-up outcome

Done well, negative reviews can increase trust because they show honesty + competence.

Listing on review platforms increases conversions because it:

1. Meets buyers where they already research (review sites are a major research input for many buyers).

2. Reduces perceived risk using peer evidence (social proof + third-party credibility).

3. Improves funnel efficiency with measurable results, including real case-study lifts in conversion rate, CPL, and sales cycle speed (e.g., ZoomInfo, Product Fruits, Scrum.org).

4. Boosts SEO and captures high-intent searches, which tend to convert better than general traffic.

5. Works best when you treat it as a system: profile quality + steady review generation + on-site proof placement + active response management.

Be the first to post comment!