Google Launches Flex: A New Era of Digital Credit Integration via the UPI Network

by Parveen Verma - 1 month ago - 2 min read

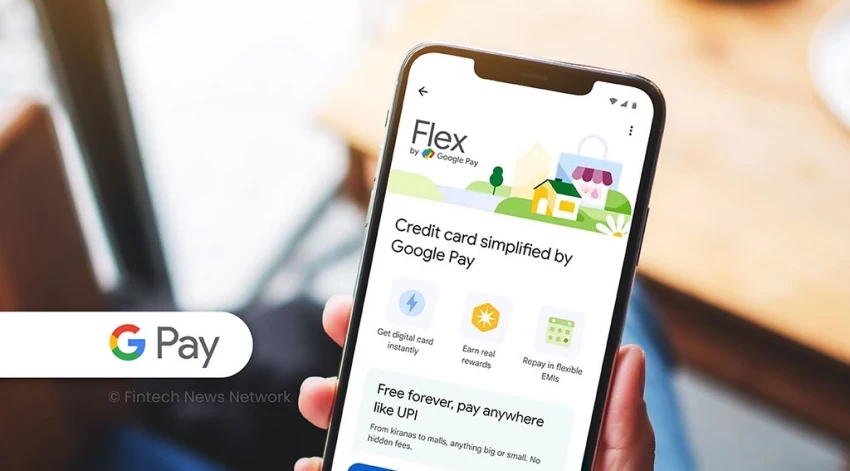

In a transformative move for the Indian financial landscape, Google has officially introduced ‘Flex,’ a digital-first credit solution that integrates the convenience of the Unified Payments Interface (UPI) with the utility of a traditional credit card. This launch represents a significant milestone in Google’s strategy to deepen its fintech footprint in India, offering a seamless bridge between short-term liquidity and the country’s most popular payment method. By leveraging the existing National Payments Corporation of India (NPCI) infrastructure, Flex allows users to access a pre-approved line of credit directly through the Google Pay interface. This innovation effectively removes the need for physical plastic cards, enabling consumers to make credit-based purchases at any merchant from large retail chains to small local vendors simply by scanning a standard UPI QR code.

The operational framework of Flex is designed to prioritize speed and user experience, moving away from the historically slow approval processes associated with conventional banking. Eligible users can activate their Flex account within the app, receiving an instant credit limit based on their financial history and spending patterns. Once activated, the "Flex" option appears alongside the user’s linked bank accounts during the checkout process. This allows for immediate financial flexibility, particularly for high-value transactions or as a buffer during month-end cash flow constraints. Furthermore, the system is built with a transparent fee structure and competitive interest rates, aiming to provide a formal and regulated alternative to the unorganized micro-lending sector.

Beyond mere transaction capability, Google has integrated a robust management suite within the Flex ecosystem to promote responsible borrowing. Users can track their spending in real-time, set personalized credit limits, and view detailed repayment schedules to avoid debt traps. The product also features a revamped rewards system called "Stars," where cashback and benefits are credited instantly, providing immediate value compared to the delayed point systems of traditional banks. As digital payments continue to scale globally, the introduction of Flex marks a pivotal shift toward the "Credit on UPI" model, positioning Google at the forefront of a movement that democratizes access to formal credit and simplifies the digital economy for millions of Indian consumers.