Micron Unveils Massive $9.6 Billion Blueprint to Establish Next-Generation AI Memory Hub in Japan

by Parveen Verma - 1 month ago - 3 min read

In a landmark development for the global semiconductor landscape, Micron Technology has finalized plans to inject approximately 1.5 trillion yen ($9.6 billion) into a new manufacturing complex in Hiroshima, Japan. This strategic expansion, reported by Nikkei on Saturday, marks a decisive step by the U.S. chip giant to cement its leadership in the booming artificial intelligence sector while diversifying its supply chain away from geopolitical hotspots. The facility will be dedicated to producing advanced High Bandwidth Memory (HBM) chips, the critical components that power the data-hungry AI processors used by industry titans like Nvidia.

The multibillion-dollar initiative represents one of the most significant foreign investments in Japan’s technology sector in recent years. Micron aims to break ground on the new facility within its existing Hiroshima campus by May 2026, with mass production scheduled to commence in early 2028. This aggressive timeline underscores the urgency within the semiconductor industry to meet the explosive demand for AI-capable hardware.

As the project timeline infographic provided below illustrates, the rapid progression from groundbreaking in 2026 to mass production in 2028 highlights the accelerated pace required to keep up with global AI adoption.

The plant will focus on manufacturing next-generation DRAM and HBM products, which are essential for the rapid data processing required by generative AI models and large-scale data centers.

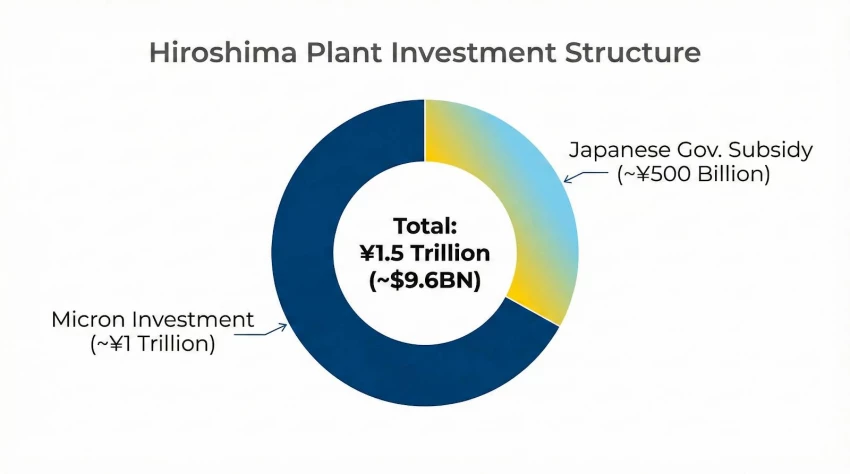

Crucially, this project is being realized with substantial backing from the Japanese government, which views semiconductor sovereignty as a top national priority. The Japan’s Ministry of Economy, Trade and Industry is expected to provide subsidies of up to 500 billion yen to support the construction and equipment procurement.

The investment breakdown chart included below visualizes the scale of this public-private partnership, showing the proportion of government subsidies relative to Micron's direct capital injection.

This financial injection is part of Tokyo's broader strategy to revitalize its domestic chip industry and reclaim its status as a global powerhouse in semiconductor manufacturing. By partnering with leading international firms like Micron and TSMC, Japan is effectively securing its position in the global digital economy.

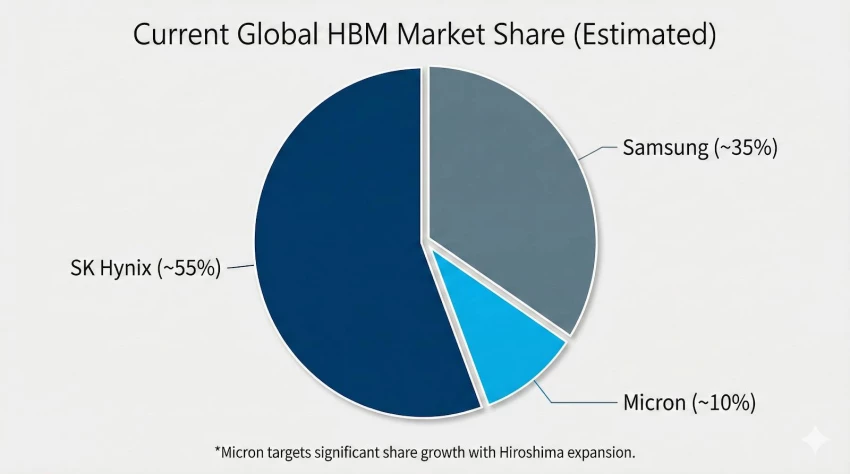

The strategic rationale behind Micron’s decision extends beyond capacity expansion. By bolstering its manufacturing footprint in Japan, the company is actively mitigating supply chain risks associated with over-reliance on production in Taiwan. Furthermore, this move positions Micron to compete more aggressively with South Korean rival SK Hynix, which currently leads the HBM market.

Reflecting the data in the market share graph below, Micron is currently chasing the market leaders, and this new Hiroshima capacity is the strategic lever intended to increase their slice of the global HBM market.

As the race for AI dominance intensifies, this facility is poised to become a cornerstone of the global AI infrastructure, ensuring a steady supply of high-performance memory for the innovations of tomorrow.