Nexperia’s Urgent Plea: Dutch Chipmaker Appeals to China Unit to Restore Global Supply Chain

by Parveen Verma - 2 months ago - 3 min read

In a stark open letter on November 27, 2025, Dutch semiconductor firm Nexperia urgently called on its China-based units to resume cooperation and help revive a disrupted supply chain that’s rattled global auto and electronics manufacturing.

What Went Wrong: From Government Seizure to Corporate Fallout

The turmoil began on September 30, when the Dutch government invoked a rarely used 1952-era law the Goods Availability Act to take control of Nexperia’s European operations. Officials said the takeover was necessary to safeguard sensitive semiconductor technology and prevent the company’s former CEO (linked to its Chinese owner Wingtech Technology) from relocating core European assets to China.

Following this takeover, a Dutch court removed Wingtech’s CEO from his post, removing Chinese leadership from European management.

In retaliation, Nexperia’s Chinese unit declared itself independent of European oversight. By October 26, after repeated payment refusals from the Chinese side, Nexperia said it halted shipments of wafers the raw silicon discs that form the basis of its chips from Europe to China.

Because Nexperia’s global production relies on a cross-border model wafers made in Hamburg (Germany) are sent to Dongguan (China) for packaging before shipping to customers worldwide the breakdown devastated its ability to deliver chips.

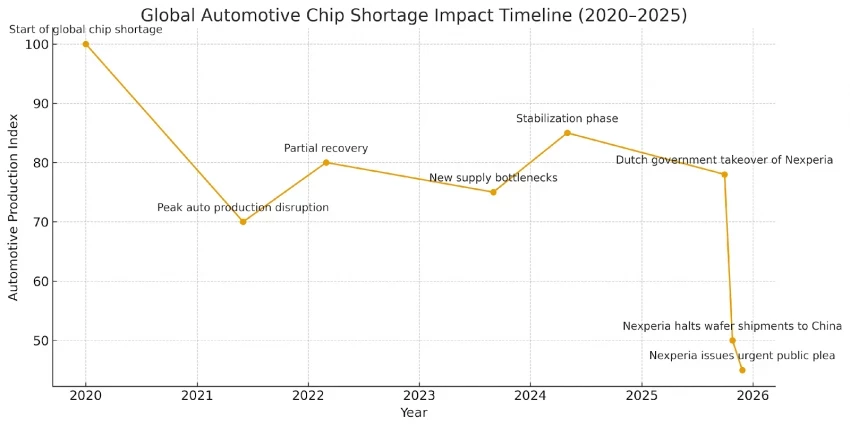

The Graph Below shows the How the Global Automotive Chip Shortage Evolved (2020–2025)

The China-based export ban that followed earlier in October compounded the problems, sending shockwaves through supply chains for European and global automakers.

Nexperia’s Plea: “Enough Is Enough”

In its public letter, Nexperia’s Dutch leadership said they had exhausted all conventional channels calls, emails, formal and informal requests for meetings but received no meaningful response from their Chinese counterparts. “Regrettably, Nexperia did not receive any meaningful response,” the letter said.

With customers across multiple industries reporting “imminent production stoppages,” the company warned that the situation “cannot persist.”

Nexperia is now demanding structured, formal negotiations either directly or via a neutral third-party mediator to restore the supply chain and ensure compliance with corporate governance standards.

Broader Impact: Automakers in Crisis

Because Nexperia produces billions of the basic “legacy chips” used in automotive electronics power management chips, logic devices, MOSFETs and more its production halt has reignited fears of an auto-industry supply crunch.

Several automakers had already begun to warn of production slowdowns or shutdowns. The freeze underscored how fragile global just-in-time supply chains remain even for older, low-complexity chips.

Diplomatic Signals, But Uncertain Resolution

There have been tentative signs of easing tension. After high-level talks between Chinese and European officials including a call between China’s commerce minister and the EU trade commissioner the government of the Netherlands suspended its takeover order last week.

Despite this diplomatic olive-branch, the core corporate fracture remains unresolved: Nexperia’s China-based entity has yet to respond meaningfully to the Dutch plea. Without cooperation, the global semiconductor supply chain and the industries dependent on it may remain in limbo.

Why This Matters

- Global supply chain vulnerability: The Nexperia crisis reveals how even “simple” and “legacy” chips remain indispensable to modern manufacturing, and how geopolitical or corporate disputes can quickly ripple across industries.

- Tightrope between security and commerce: The Dutch intervention highlights growing European caution over foreign control of strategic tech firms yet the business fallout shows the high cost companies and economies pay for such moves.

- Need for supply-chain resilience: For automakers and electronics firms relying on just-in-time chip deliveries, the episode is a wake-up call to diversify sourcing and reduce dependency on any single supplier or geography.