Tesla Records First Annual Revenue Decline as Strategic Shift to AI and Robotics Accelerates

by Suraj Malik - 1 hour ago - 4 min read

Tesla has reported its first-ever annual revenue decline, signaling a pivotal moment for the electric vehicle pioneer as it intensifies its transformation into an artificial intelligence and robotics-focused company.

The company said revenue fell 3% in 2025 to $94.8 billion, down from $97.7 billion the previous year. Net profit dropped more sharply, declining 46% to $3.8 billion, marking Tesla’s weakest annual profit performance since the pandemic. Vehicle deliveries also fell 8.6% to 1.64 million units, underscoring growing pressure on Tesla’s core automotive business.

The results come as Tesla, led by chief executive Elon Musk, executes a dramatic strategic pivot away from traditional car manufacturing toward autonomous driving, humanoid robots, and AI-driven services.

Loss of EV Market Leadership

Adding to the symbolic weight of the results, Tesla lost its position as the world’s largest electric vehicle manufacturer to China’s BYD. BYD sold approximately 2.25 million battery-electric vehicles in 2025, compared with Tesla’s 1.64 million—a swing of more than 600,000 units year over year.

The shift reflects both BYD’s rapid expansion and Tesla’s contraction, particularly in Europe, where Tesla registrations fell 28%, and in China, where competition from domestic manufacturers has intensified. Analysts also point to the expiration of the US $7,500 federal EV tax credit in late 2025 as a major headwind for Tesla’s sales momentum.

End of the Model S and Model X

During its fourth-quarter earnings call, Tesla confirmed plans to end production of the Model S and Model X, its longest-running vehicles. Production will wind down in early 2026, with the Fremont, California facility repurposed to support Tesla’s humanoid robot program, Optimus.

Once flagships of Tesla’s line-up, the Model S and X now account for an estimated 3% of deliveries, compared with roughly 97% from the Model 3 and Model Y. Aging platforms, limited redesigns, and high production complexity made the models increasingly difficult to justify, according to analysts.

While Tesla said it will continue to support existing Model S and X owners, the decision marks the end of an era for vehicles that helped define the company’s rise.

Pivot Toward AI, Robots, and Robotaxis

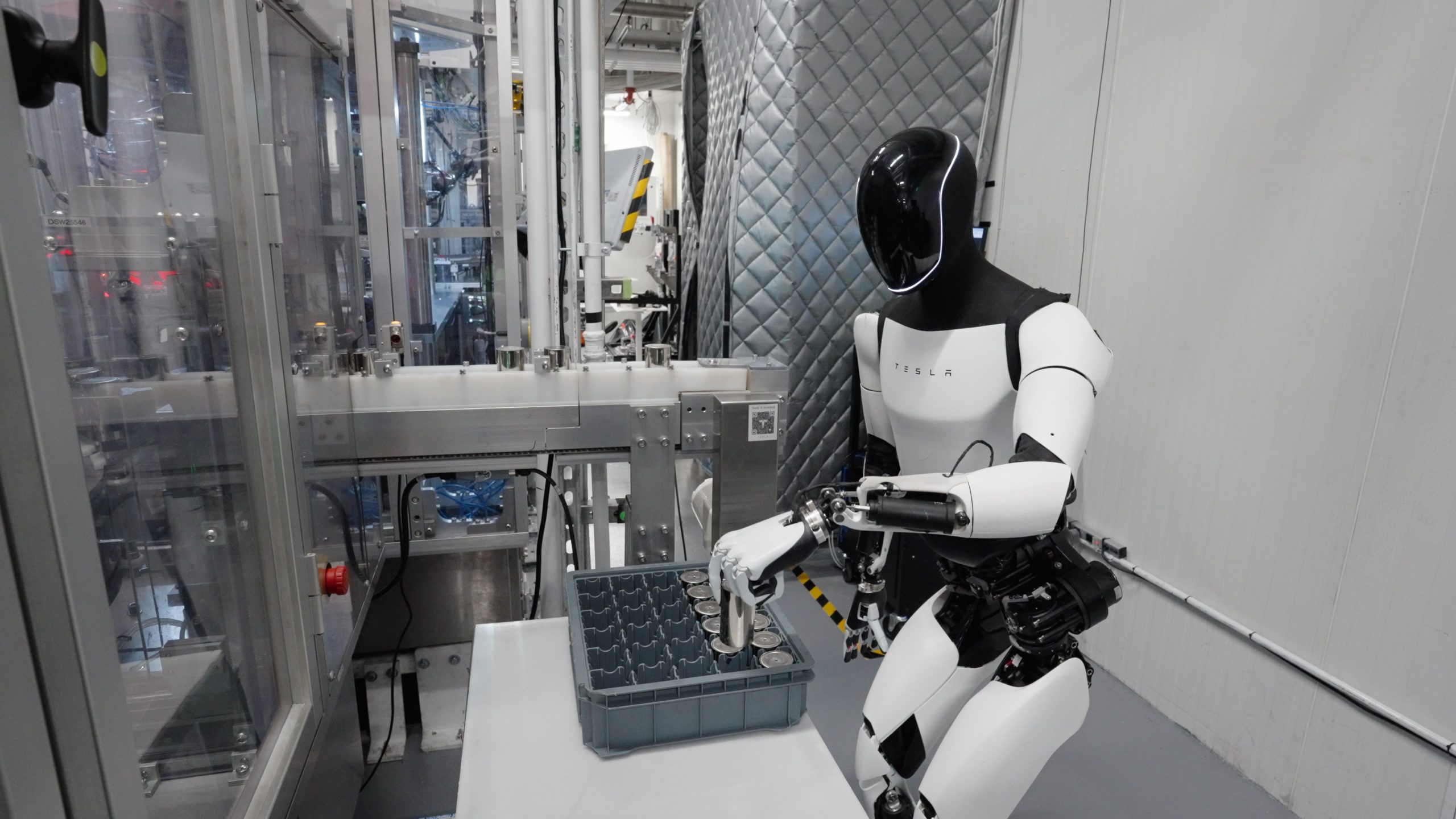

Central to Tesla’s future strategy is Optimus, its humanoid robot designed for industrial, logistics, and eventually consumer applications. Musk has outlined ambitions to produce up to one million Optimus units annually in the long term, though the technology remains at an early stage.

Tesla is also expanding its robotaxi efforts through its Full Self-Driving (FSD) platform. The company reported 1.1 million FSD subscribers, up 40% year over year, and continues to operate a limited robotaxi pilot in Austin, Texas. However, FSD still requires human supervision and does not meet full autonomous driving standards.

Despite ambitious projections—Musk has previously suggested robotaxis could generate tens of billions in revenue—commercial-scale deployment remains constrained by regulatory hurdles and technical limitations.

Massive Investment Program Raises Stakes

Tesla plans to dramatically increase capital spending, with $20 billion in planned expenditures for 2026—more than double its 2025 capex. The investment will fund AI infrastructure, data centers, robotaxi expansion, Optimus production, and factory upgrades.

The company also disclosed a $2 billion investment in xAI, Musk’s artificial intelligence startup. Tesla said the move aligns with its goal of embedding AI into physical products, though the decision has raised governance concerns due to Musk’s leadership roles at both companies.

Despite weaker financial performance, Tesla shares rose about 2% in after-hours trading, suggesting investors remain focused on long-term AI and robotics potential rather than near-term automotive declines.

A Company at an Inflection Point

Tesla’s first revenue contraction reflects more than a cyclical slowdown—it highlights a company in transition. Its automotive business faces mounting competition, pricing pressure, and an aging product line-up, while its future bets on AI, robots, and autonomy remain largely unproven at scale.

Supporters argue Tesla is positioning itself for markets far larger than automotive, with higher margins and long-term growth potential. Critics counter that the company risks weakening a still-profitable core business to pursue technologies that may take years to mature.

With revenue declining and spending accelerating, the next two years will be critical. Whether Tesla successfully reinvents itself as an AI and robotics leader—or struggles under the weight of its ambitions—will define the next chapter of one of the world’s most closely watched companies.