Reviews

6 min read

ClearOne Advantage Debt Relief Review: Real Customer Feedback

Managing unsecured debt can be overwhelming, and for those seeking solutions, debt settlement companies like ClearOne Advantage have become increasingly visible. This review provides an objective look at ClearOne Advantage, drawing on customer feedback and industry data to help readers make informed decisions.

ClearOne Advantage is a debt settlement company founded in 2008. Its role is to negotiate with creditors on behalf of clients, aiming to reduce balances on unsecured debts such as credit cards, personal loans, and medical bills. Unlike lenders or nonprofit credit counseling services, ClearOne operates strictly as a debt negotiator to help clients settle for less than the original balance.

The company emphasizes personalized programs and structured payments, but as with any financial service, results vary by client situation. Interestingly, reviews of fintech tools like Julius AI, an analytical chatbot, highlight how consumers increasingly demand transparency and clear decision support in financial products—a standard debt relief companies are also being measured against..

The ClearOne Advantage process generally follows these steps:

The duration of the program typically ranges from two to five years, though some clients may see their first settlements within a few months. The company states that, including fees, most clients pay less than 75% of their original enrolled debt, but individual results vary.

Positive Aspects

Reported Concerns

| Platform | Average Rating | Noted Points |

| ConsumerAffairs | 4.9/5 | Staff, process, and transparency rated highly |

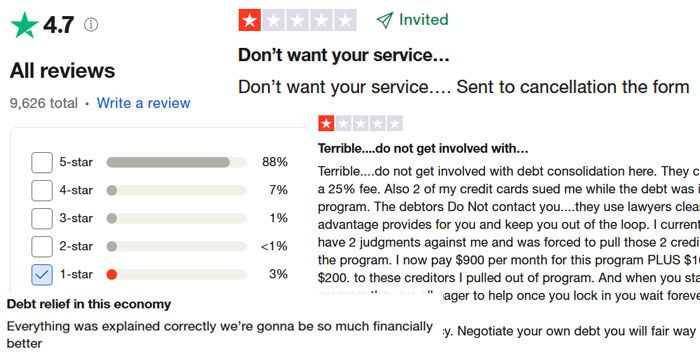

| Trustpilot | 4.7–4.8/5 | Positive feedback on support and clarity |

| BBB | 3.7–4.0/5 | Professionalism noted; some complaints about delays |

| Google Reviews | 4.4/5 | Helpful staff and clear communication |

| Yelp | 1.3/5 | Mixed; some cite flexibility, others high costs |

Ratings vary by platform, with some showing high satisfaction and others highlighting unresolved issues.

| Company | Avg. Rating | Fees | Minimum Debt | BBB Rating |

| ClearOne Advantage | 4.4/5 | 20–25% | $10,000 | A+ |

| New Era Debt Solutions | 4.9/5 | 14–23% | $10,000 | A+ |

| TurboDebt | 4.9/5 | 15–25% | $10,000 | A+ |

| Freedom Debt Relief | 4.6/5 | 15–25% | $10,000 | A+ |

| Pacific Debt Relief | 4.8/5 | 15–35% | $10,000 | A+ |

While ClearOne Advantage is competitive in terms of customer service and transparency, some competitors offer lower fees or higher customer ratings.

Clients frequently mention reduced stress, lower monthly payments, and supportive staff. The online portal is praised for keeping them informed.

However, frustrations are also reported: slow settlements, increased payment terms, and misunderstandings about credit impact. These experiences align with community discussions—such as this Reddit thread in r/debtfree—where users debate whether ClearOne’s promises match actual performance.

Pros

Cons

ClearOne Advantage may be an option for individuals with significant unsecured debt who are unable to keep up with payments. The program’s structure and support are cited as strengths, but there are notable risks, including credit score damage, potential delays, and legal action from creditors.

Before enrolling, it is advisable to compare ClearOne Advantage with other debt relief options, such as nonprofit credit counseling, debt management plans, or bankruptcy. Understanding the fees, process, and potential impact on your finances and credit is essential.

ClearOne Advantage offers a debt settlement program that has helped some clients reduce their unsecured debt and regain control of their finances. However, the program is not without drawbacks, including credit score implications and the possibility of legal action. Prospective clients should carefully weigh the pros and cons, review customer feedback, and consider consulting a financial counselor before making a decision. Making an informed choice is crucial for achieving long-term financial stability.

1. Is ClearOne Advantage a legitimate company?

Yes. ClearOne Advantage has been operating since 2008 and holds an A+ rating with the Better Business Bureau (BBB). However, like all debt settlement services, results vary by client, and it’s important to read customer reviews before enrolling.

2. How much does ClearOne Advantage charge in fees?

Fees generally range between 20% and 25% of the enrolled debt. Clients do not pay upfront; fees are collected only after a settlement is successfully reached.

3. Will ClearOne Advantage hurt my credit score?

Yes. Because the program requires stopping payments to creditors, accounts go delinquent, which negatively impacts credit scores. Missed payments may stay on your credit report for up to seven years.

4. How long does the ClearOne program take?

The program typically lasts 2–5 years, but some clients see their first settlements within a few months. Duration depends on debt size, creditor negotiations, and consistent payments into the escrow account.

5. What types of debt qualify for ClearOne Advantage?

ClearOne Advantage works with unsecured debts, such as credit cards, personal loans, and medical bills. Secured debts (like mortgages and auto loans) are not eligible.

6. Are there risks to using ClearOne Advantage?

Yes. Risks include a damaged credit score, possible legal action from creditors, and settlement delays. As shared in Reddit’s r/debtfree discussion, some clients have experienced lawsuits and collection pressure while enrolled.

7. How does ClearOne compare to other debt relief companies?

ClearOne Advantage is competitive in customer service and transparency, but some competitors—like New Era Debt Solutions or Pacific Debt Relief—offer lower fees or slightly higher ratings.

Be the first to post comment!