Many people only learn about Inspira Financial when an old retirement or health account gets transferred there without their consent. The company evolved from PayFlex and Millennium Trust, rebranding itself as a combined health and wealth administrator.

This sudden shift has raised concerns. Users often discover their 401(k) or HSA has been redirected to Inspira, leaving them scrambling to understand new rules, fees, and login processes.

The company manages a wide set of offerings: health savings accounts (HSAs), flexible spending accounts (FSAs), COBRA, and automatic rollover IRAs.

Automatic rollovers are particularly controversial. Employers can transfer “orphaned” balances into Inspira without employee approval. While this keeps funds in tax-advantaged accounts, many report it as a forced transition they didn’t ask for.

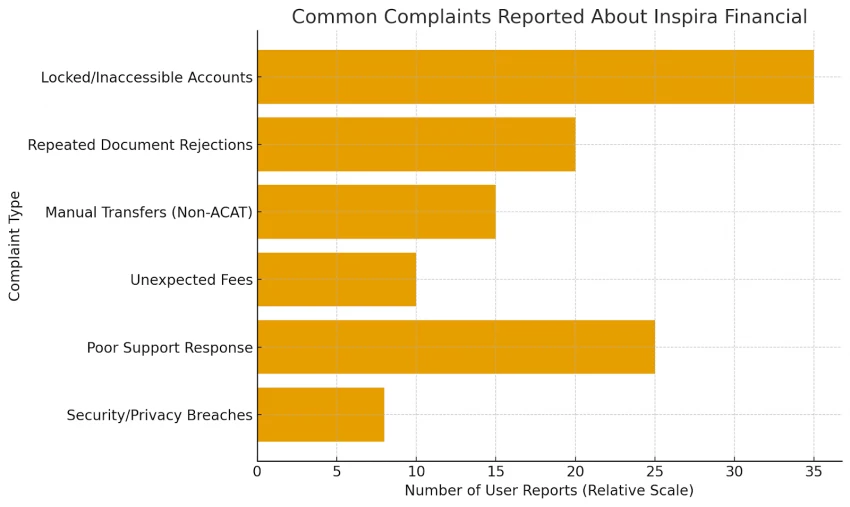

On Reddit, a user described their retirement funds being locked in a loop of failed submissions. Another thread reported endless document requests, with Inspira claiming papers were “missing” even after resubmission.

Yelp reviews echo this frustration, with one customer saying they had been “trying for four months to withdraw funds” with no success. On Trustpilot, complaints focus on delayed rollovers, poor communication, and long waits for refunds.

The Inspira website and mobile app receive harsh criticism. Several users claim the portal routinely crashes, leaving them unable to access balances or submit claims. In fact, one detailed Reddit thread highlights repeated login failures and broken online forms.

Worse still, Inspira is not ACAT-eligible — meaning transfers must be handled manually rather than electronically, creating additional delays.

Customer support is the consistent weak link. Inspira’s Trustpilot reviews show a pattern of unresponsiveness and “runaround” responses. The Better Business Bureau has logged dozens of unresolved complaints involving inaccessible funds and poor communication.

A troubling report by PlanSponsor revealed that a call center employee improperly accessed the data of over 2,000 retirement accounts — further eroding user trust.

Reviews on Glassdoor and Indeed suggest internal issues. Workers describe poor communication, disorganization, and favoritism. High turnover and a lack of clear leadership likely contribute to the chaotic customer experience.

Some employees do praise remote flexibility, but overall, the picture points to structural weaknesses that spill over into customer dissatisfaction.

A lawsuit, Hewitt v. Capital One & Inspira Financial, alleges that Inspira (formerly Millennium) accepted retirement transfers while offering yields far below benchmarks. This raises questions about fiduciary responsibility.

Combined with security lapses and mounting BBB complaints, the legal spotlight on Inspira is growing.

Some users on Trustpilot note that, once hurdles were cleared, transactions processed smoothly. A few even credit specific customer service agents for being responsive and helpful.

But these positives are overshadowed by widespread complaints, making consistency the biggest challenge for Inspira.

Monitor your balances closely and log into your account as soon as you’re notified of a transfer.

Inspira Financial sits at the crossroads of health and retirement account administration, but its reputation is tarnished by inconsistent support, broken technology, and legal scrutiny.

While some customers eventually resolve their issues, many face delays, unresponsive service, and security concerns. Until Inspira addresses these flaws, consumers should treat unexpected account transfers with caution, and be prepared to fight for access to their own money.

Be the first to post comment!